Pleasanton Budget Explained

Constructing the annual Pleasanton budget boils down to matching anticipated revenues against the residents’ short term and long-term needs from the city. By law, the adopted budget must be balanced one against the other.

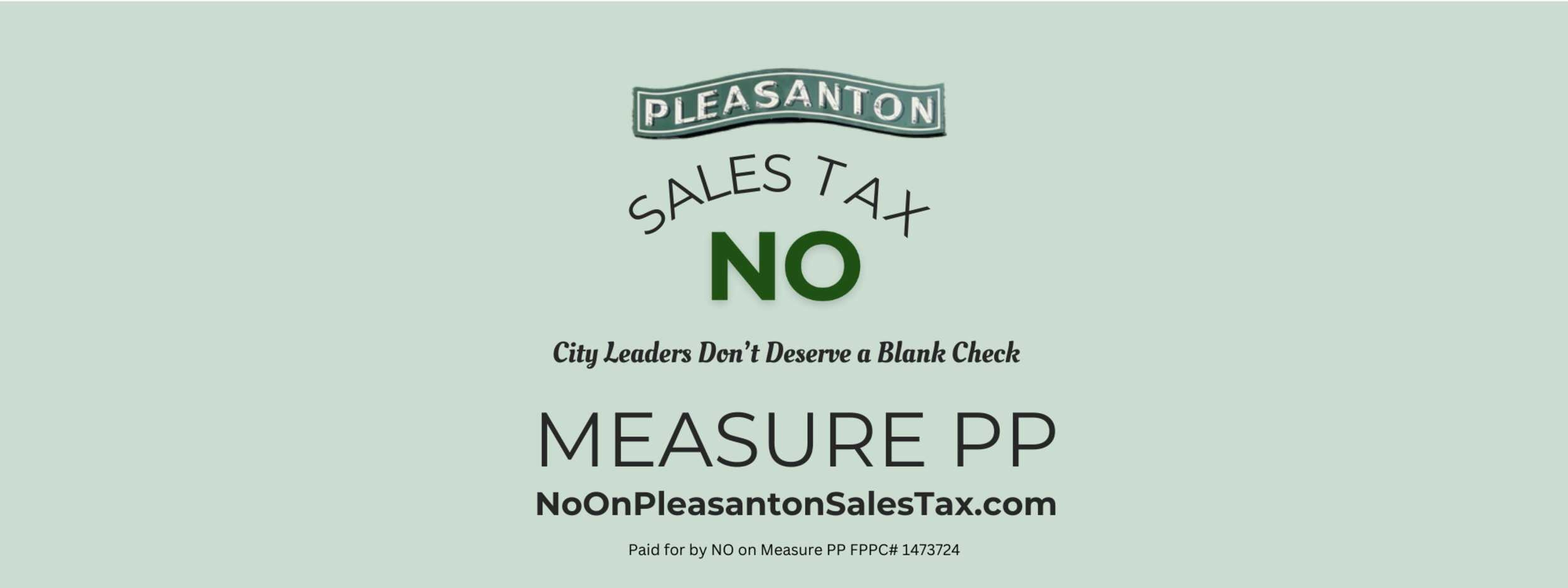

Pleasanton’s leaders are claiming we’re out of balance by $13 million, on average, every year for the next decade. In truth, our leaders can construct a budget today that is balanced and that doesn’t make the essential services cuts they are threatening to implement.

The funds spent by the City each year are contained in the General Fund. Tax collections, grants, fees, contract income and whatever other forms of revenue that may exist all flow into the General Fund. Operations, personnel, capital projects, debt and other liabilities are all paid out of the General Fund.

Special funds have also been created by the city for prudent fiscal management. These funds are either tied to services that generate fees to help pay for those services (as in the case of water), or as set asides, or reserves, to better manage long term liabilities (as with the pension liability or for capital projects) or for unanticipated expenses (such as the reserves as a rainy-day fund). When used, expenditures are paid directly out of these special funds for budgeted items.

Taxes collected by Pleasanton include property, sales, franchise fees, business license fees and transient occupancy taxes (“hotel tax”). The property tax is by far the largest revenue source and the sales tax is second largest. The city also collects a number of fees for recreational activities, development services and the like.

On the expenditures side, the largest single cost is personnel salaries and benefits. Another significant cost relates to capital projects, both direct expense as well as an annual set-aside into the Capital Improvement Program fund for allocation to pay for approved projects. After these two items, general operations substantially covers the balance of city activities.

Capital costs include construction of buildings, roads and public spaces, as well the maintenance of all city facilities. Every year Pleasanton leaders assess what can be afforded over the subsequent two years and what needs to be deferred. Some years more ends up being deferred but all capital projects are planned and included in the annual budget.

The Pleasanton General Fund budget for the 2024-2025 fiscal year (July to June) as initially adopted totaled $235.7 million. On the revenue side, property taxes were projected to provide $91.5 million and sales tax $27.8 million. Since adopted, the budget has been updated by the City Council based upon what’s occurred thus far in the year. As explained elsewhere on this site, budgets are set based upon assumptions and expectations that almost always deviate from what actually ends up happening.

The special funds and reserves are just as important in funding the budget as are the tax revenues. These are real taxpayer funds that have been set aside with the intent to be used for its stated purpose.

A perfect example is the Section 115 Pension Trust Fund. As explained elsewhere on this web site, this fund was created to help retire a pension liability owed to the California Public Employees Retirement System (PERS). This liability exists as a result of the retirement benefits provided to Pleasanton employees hired prior to 2012. By creating the Trust Fund, prior city leaders recognized the need to set aside money that would earn investment income until used to help smooth the annual liability payments. The Fund has not yet been used for this purpose and is growing. The Fund currently totals approximately $51 million.

A similar special fund was created out of reserves to pay the costs of the medical benefits enjoyed by certain retired Pleasanton employees. The amount currently in this fund is approximately $67 million and is sufficient to pay 90% of the outstanding liability for these retiree medical benefits.

Whether money to fund the budget comes from taxes or fees or enterprise income or grants or special reserve funds, it’s all taxpayer money to be used to balance the City’s budget each year.

So how did we end up with a supposed $13 million annual deficit projected for the next ten years?

It’s because Pleasanton leaders decided to use some, but not all, available funds to balance the city’s budget. And they used inappropriately conservative assumptions to predict tax revenues in the coming years. The truth is really that simple.

Elsewhere on this web site, you will read how our leaders constructed a budget that ends up with a $13 million deficit when a budget can just as easily be designed today that is balanced – and without cutting public safety, library hours, park maintenance, school crossing guards and all the other things being threatened by Pleasanton leaders.

Put simply, we are being sold a bill of goods and the right question is what do our leaders really want to do with taxpayer funds they don’t need to balance Pleasanton’s budget?

Now, that’s a good question.